Crypto's Monetization Problem

Valuable Blockspace is Scarce

One of the main issues within crypto historically has been that chains cannot monetize activity on their chain efficiently. This stems from a few different factors. First, one common argument has been that blockspace is abundant, and therefore there is little reason to monetize it aggressively, as switching costs are minimal for both users and applications. Apps can fork their code and run it on another chain with minimal changes, and users can simply add a network on Chainlist and transact elsewhere. Improvements in bridging and interoperability have arguably made this even easier.

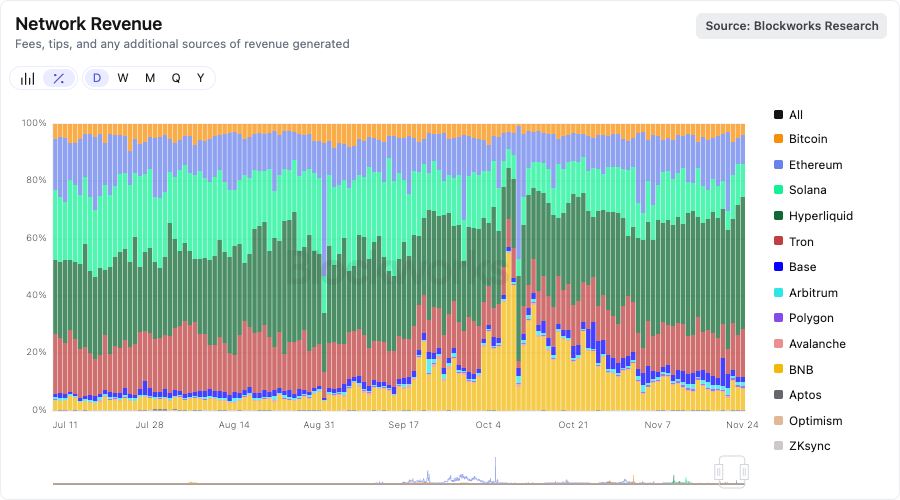

Despite this, we have also seen increasing consolidation of activity among a handful of chains. The majority of activity occurred on Solana and Base throughout 2024 and early 2025, and more recently it has been dominated by Solana, Base, Hyperliquid, Ethereum, and BNB.

This is evident not only in activity and revenue by chain, but also in which chains applications and wallets choose to support. Applications, protocols, and wallets are profit-motivated. They will launch where they believe they can generate returns. Although chain switching costs are not particularly high for applications (especially EVM-to-EVM and SVM-to-SVM), it makes little sense to spend capital and developer resources launching on a chain where the application will generate no revenue. There are exceptions: sometimes applications launch on chains for ideological reasons, because chains pay them to do so, or due to erroneous forecasting where the expected growth fails to materialize. By and large, however, applications are profit-oriented and seek to launch on chains where they can make money.

There are many examples of this:

- Phantom integrated Base, Bitcoin (during the Runes and Ordinals craze), and HyperEVM, despite being a Solana-first wallet.

- Aerodrome and Velodrome launched on Base even though the original instance was on Optimism.

- Many applications on Base and Ethereum have expanded to Solana (Fluid via Jupiter Lend, Virtuals, time.fun, among others).

- Bridges like DeBridge and LayerZero, along with terminals like Bullpen and Axiom, integrated Hyperliquid relatively quickly.

Another lens here is examining business mistakes made by applications. For example, Lido decided to remove support for its Solana LST product two years ago. This was objectively not the correct business decision.

Based on these examples, it is clear that valuable blockspace is not abundant. Profit-motivated applications deliberately choose where to launch based on potential revenue prospects.

Blockspace Monetization is Unstable

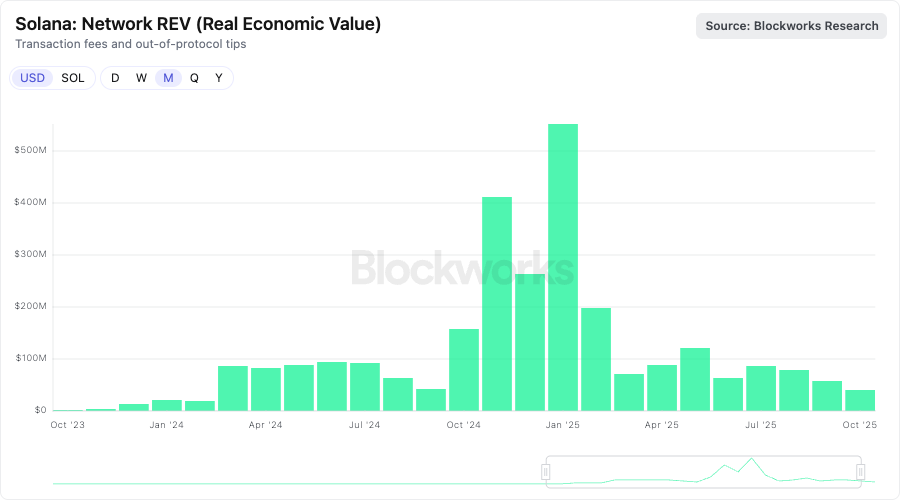

This dynamic is also visible in application revenue data. Solana network REV compressed from 821 million USD in Q1 2025 to 222 million USD in Q3 2025, a 73% decrease. Solana application revenue decreased from 970 million USD in Q1 2025 to 461 million USD in Q3 2025, only a 53% decrease. Solana as a chain has borne the brunt of the decline in activity, while applications have still suffered but to a lesser degree.

The main reason behind this is the way that chains monetize. Chains charge a flat fee to consumers, as well as additional tips and priority fees during times of peak activity, which are not always captured fully by the chain itself. This leads to exponentially increased fee generation during times of heightened demand and activity. A prime example is Solana during January 2025, inarguably the peak of memecoin activity. The chain generated 551 million USD in fees, of which 296 million was out-of-protocol tips (Jito) and 241 million USD were in-protocol tips (priority fees). In essence, 97.4% of the fees generated by Solana in January were due to surge pricing. Similarly, Base generated 13.5M USD in fees in January 2025. Of these, 10.6M USD were priority fees. Effectively, 78.5% of fees generated by Base in January were due to surge pricing.

This is not a particularly sustainable solution for monetizing blockspace. The primary argument for this low base fee, high priority fee model is that it allows fees to stay low during normal periods, while users who need to urgently get transactions through during heightened activity pay an additional fee to ensure success. The argument has also been shaped by the fact that Ethereum lost ground to chains offering lower fees and higher performance. In an infinite race to fee compression, where chains compete by offering lower fees and better performance than their competitors, it makes sense to offer the lowest fees possible and charge higher surge pricing.

However, there are some drawbacks to this monetization model. Firstly, when heightened activity subsides, you see a significant drop in the amount of fees and revenue generated. You become reliant on extremes of hype and attention. In addition, this puts chains in a dilemma. They can charge higher fees to consumers, but consumers are cost sensitive and may leave for other chains. This could lead to activity dropping in a similar fashion to how Ethereum lost activity when lower cost alternatives emerged.

Trading MON

The main reason behind this article is the recent launch of Sunrise, a platform by Wormhole that allows non-native tokens on any chain to be issued on the Solana blockchain. Sunrise was a massive success for Wormhole with their first launch of MON, the native token for Monad. In total, in the first 24 hours of trading, 55.2M USD of volume for MON trading has happened on Solana, across 228.4K transactions. Solana’s main competitor for onchain trading, Hyperliquid, saw only 35.4M USD in spot trading volume.

Despite this being a huge success, the net fees that Solana made off of MON trading was low. On the 24th of November, the average transaction fee on Solana was $0.00493, while the median transaction fee was $0.00071. There were a total of 158.2K trades involving MON, based on Helius’ new Solana explorer, Orb.

Based on napkin math that almost certainly underestimates, Solana made $780 based on average transaction fees and $112 based on median transaction fees. In comparison, Hyperliquid (assuming 0.040% fees on volume and only taking 50%, with the remainder going to the deployer Unit) made $7,065, which is nine times more than Solana, on 36% lower volume.

One last comparison here is Meteora, which was responsible for 5 million USD of volume on Solana through a single MON-USDC pool. The pool had a protocol fee of 0.01%, which means that this one pool made approximately $500, more than Solana itself. A single pool with less than 10% of the MON volume on Solana potentially made 4.4 times more than Solana, or only 35% less than Solana, depending on which fee estimate you use.

Intuitively, applications on a chain will always make more money than the chain itself. Part of this is because those who own the end user tend to capture the majority of value. The other part is that applications are simply much better at monetizing compared to chains. This makes sense. Amazon makes less money than all of the businesses using AWS make.

However, Amazon also does not charge users for businesses building on top of it. It does not make Netflix users pay extra money to use Netflix. Instead, Netflix pays Amazon for AWS and bakes these costs into its own pricing, passing some or all of it onto users. In addition, Amazon does not see 90% of its revenue compress when people stop using Netflix. They have a steadier and smoother revenue profile.

Solutions

There are three solutions to this monetization problem:

- Build out one very strong application that can help you generate revenue. The chain is built around this one application.

- Build out multiple, basic, but necessary applications that can help you generate revenue.

- Charge applications building on top of you rent/a subscription fee.

One Very Strong Application

The primary example for this is Hyperliquid. As an application, Hyperliquid is able to monetize more clearly and easily.

The HyperCore chain technically has no gas fees, but a fee is charged on volume and trades (effectively a transaction fee). Fees on Hyperliquid (or any DEX) scale with volume, therefore the chain charges higher fees to more volume, while on typical blockchains the same fee is charged for vastly different volumes.

Trading fees are expected by users, most brokerages or exchanges follow a trading fee based model (although some use PFOF). Both HyperCore and HyperEVM value accrues to the HYPE token (HyperCore has a programmatic buyback based on fees, and HyperEVM burns 100% of base and priority fees) therefore revenues are not split across multiple tokens.

This solution naturally fits with applications that can themselves become app chains. As of today, the clearest fit is perpetuals DEXs, initially with dYdX, and more recently with Hyperliquid and Lighter. This is not a natural fit for all chains or products. Many applications have wasted capital and developer resources attempting to launch their own chains, and many chains have wasted capital and developer resources attempting to build their one killer product.

Build Out The Basics

There have been multiple attempts at building out basic applications at the chain level, and internalizing revenue from that:

- Berachain had BEX, BEND and HONEY (their native DEX, lending platform and stablecoin), which were all intertwined.

- Sui has DeepBook (onchain orderbook DEX) and Walrus (data storage platform). The team has chosen to launch separate tokens for both these platforms, meaning that the SUI token does not necessarily benefit off of these, at least to the full extent.

- Hyperliquid is working on BLP, rumored to be a borrowing and lending protocol built-natively into HyperCore. There are no clear announcements with regard to the protocol, but presumably, revenues will accrue to the HYPE token as well.

- MegaETH has announced that they will launch their own native stablecoin, USDm, in partnership with Ethena. USDm’s underlying reserve yield will be programmatically directed to cover sequencer operations. This will be used to keep gas prices low.

There are two common pushbacks towards chains internally building out basics:

- You are competing with applications building on your chain.

- Building blockchains is difficult, capital and developer resources are limited, and the skillset is different to building applications.

Both of these pushbacks are correct at face value. By building out basic applications (a simple Aave style monolithic lending platform, a simple liquid staking protocol or a simple CLMM DEX) you are competing against applications building on your chain. However, there are also benefits. Firstly, you can internalize the revenue that the application makes, and accrue it towards your native token. Secondly, you are discouraging lazy forks to launch on your chain Day 1, generating revenue that you could generate yourself. If an application is going to build on your chain, it should be required that they build something unique, that can outcompete a simple Aave V3 or Uniswap V3 fork. Lastly, you are giving users a trusted, Day 1 DEX, LST or money market to use.

Rent-Seek

As of today, there are only a few chains that are comfortable with charging teams building on top of them:

- Ethereum, Arbitrum and Optimism charge a (relatively) low amount to chains building on top of them.

- Hyperliquid charges protocols building on top of it 50% of revenues.

Likely the easiest way for chains to monetize their blockspace more efficiently is to rent-seek, and charge applications building on top of them. For this to be viable, chains must have achieved a reasonable amount of adoption. This has been the base for why I predominantly discussed Solana and Base throughout. Both have strong distribution and actually valuable blockspace, and both have become lindy-enough, that they can likely start charging protocols building on top of them, without the majority of them leaving to competitors.

If building on top of a chain increases the fees and revenue that a protocol makes significantly (as is the case with Base, Solana and Hyperliquid, and to a lesser extent with BNB and Ethereum) it should feel free to charge a fee, taking a percentage of profits generated by the protocol. This can be a fixed amount, or one based on being a portion of net profits.

This also allows blockchains to shift their monetization model from consumers to businesses as well. Blockchains are B2B businesses which monetize B2C. Individual users are more cost sensitive. They are also often less profitable onchain. Businesses are generally profitable onchain, and are less cost sensitive, especially since their revenue is directly correlated with the amount of activity on the chain they are building on. They also have higher switching costs. It is increasingly easier to bridge over from one chain to another, even if they use different VMs. However, launching a new instance on another chain is more difficult.